When The Advertised Price Isn’t The Price (Part 2)

Discover actionable strategies to maximize tuition discounts—building a high-discount college list, timing applications, showcasing your fit, and negotiating your aid package—to lower what you pay.

Most students and families do not pay the advertised (sticker) price for college.

Continuing our story from Part 1, where we explored free tools you can use to estimate what you’d pay, let’s now jump into ways to maximise your discounts.

A reminder that you can do much of this work up front, before even applying to a college.

Tips to Maximize Tuition Discounts

Colleges compete for students by adjusting their “sticker” price down for those they most want.

Now that you know that, you can use these tactics to land in their high-discount buckets:

1. Build a High-Discount College List

This is by far and away the most important thing you can do!

Set yourself up to have choice from a financial standpoint by researching each school’s published discount rate (share of tuition covered by institutional aid) and focusing on schools with average discount rates over 50 %—often small privates and mid-tier publics. You can use the tools from my prior post to help with this research.

You want your academic profile to be in the top 50% of the institution to which you are applying (or to qualify “automatically” for merit aid - see this post). This gives you the best shot at a college really wanting you to attend.

And you are looking for schools where a majority of students are receiving merit aid (also called non-need based aid).

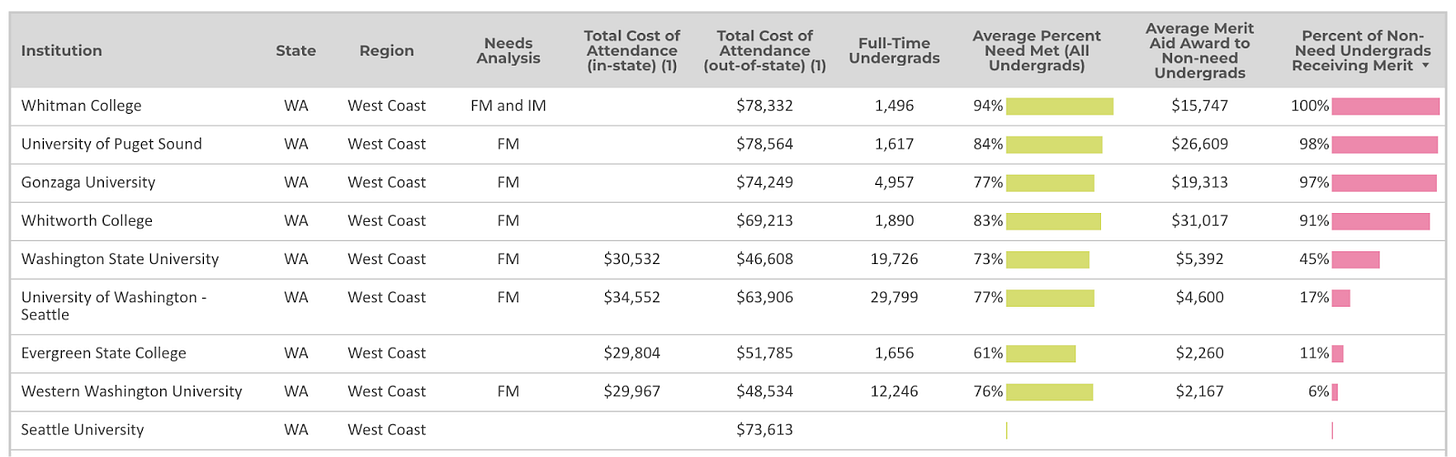

An example from colleges in Washington state clearly shows that at the small liberal arts colleges almost all students are paying less than sticker price.

2. Leverage Application Timing

Apply Early Action (EA).

Applying early signals commitment and can unlock extra merit awards.

Note that Early Action (EA) is different than Early Decision (ED).

Early Action (EA) is applying early to get an answer back early. You are not obligated to attend and can weigh EA offers alongside offers from other schools. Early Decision (ED), by contrast, is a binding agreement where if admitted you promise to attend. You only apply to one school at a time Early Decision (ED).

Early Action (EA) maximises your financial aid options.Early Decision (ED) tends to limit them.

A surprising number of schools reserve their top merit funds for early pools; apply Early Action (EA) soon after the first deadline for best odds.

3. Demonstrate Fit & Value

Tailor your essays, visit the college (if you can), and optionally participate in interviews and discussions with admissions staff.

Show why you’re uniquely aligned with a program’s mission—aid committees love demonstrated interest.

4. Apply for Departmental & Honors Scholarships

There are often major-specific awards: Many STEM, business, or arts departments offer guaranteed scholarships for declared majors.

Honors programs: Admission into honors colleges often includes a merit stipend and priority housing—apply separately if available.

Proactive list-building and precise application timing position you in the cohort that schools most want—and reward—with deeper discounts.

5. Appeal & Negotiate Your Aid Package

Even top-tier offers can improve. A well-timed appeal can unlock additional funds or better align packages with your needs.

This requires three steps:

STEP 1: Compare offers

Line up your net-price estimates from all acceptances. Again, this works if - and only if - you’ve built a high-discount college list that has given you financial optionality and choices.

If School A’s net cost is $5k lower than your top choice (School B), use that offer as leverage.

STEP 2: Submit a formal appeal

Write a concise letter to the financial aid office: restate your enrollment intent, share competing offers, and document any changed circumstances (e.g., job loss, medical bills).

You’ll want to include supporting docs such as benefit statements, tax updates, or award letters from peer institutions.

STEP 3: Do all this ahead of deadlines

Most appeals must be filed by May 1 (National Reply Date).

Begin gathering letters and financial updates as soon as your initial package arrives—don’t wait until the last minute. Again, this is where applying Early Action (EA) can help, as you’ll have more time to receive and consider offers.

Many of us - myself included! - don’t enjoy negotiating over financial matters. But the reality is that paying for college isn’t that different from other expensive purchases such as cars and houses where there are often offers, counter-offers, and so on.

Remember that you always have the option of where to spend your money, and how much to spend.

Financial Aid appeals aren’t just for need-based adjustments; merit awards can be bumped too. A clear, fact-based request can yield extra thousands of dollars.