When The Advertised Price Isn’t The Price (Part 1)

Estimate your true college cost—beyond the sticker price—using Net Price Calculators, NCES College Navigator, U.S. College Scorecard, and national cost benchmarks for informed financial planning.

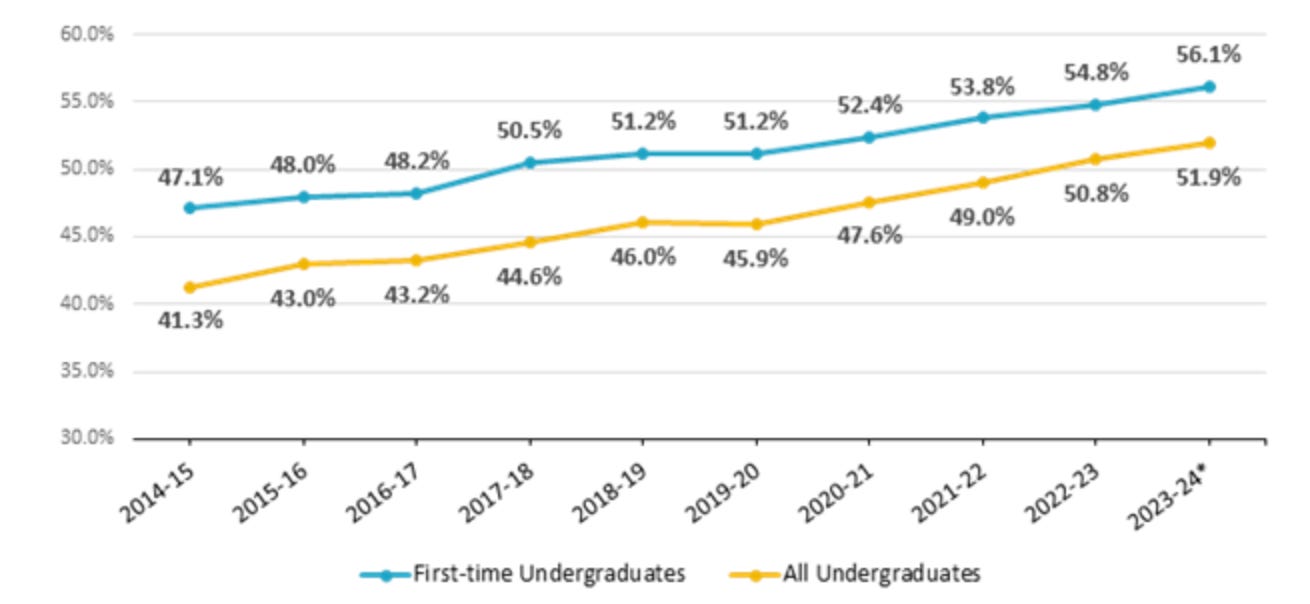

“In fact, no more than a few dozen other schools can command Ivy League prices from a high percentage of their students and their families. Every other private institution — and most public ones — compete brutally on price up until the May 1 reply date each year (and sometimes afterward). The average tuition discount among private colleges is now over 56 percent for first-time, full-time students.

Those discounts — which often come in the form of merit scholarships — can make a six-figure difference in what families pay over four years. This aid is different and often less predictable than the need-based kind that depends on a family’s income and assets.”

https://www.nytimes.com/2025/05/01/business/college-tuition-price-consultants.html

The truth is everyone is in search of a deal.

Business leaders have known about the power of price anchoring for a long time. And now colleges know this too. Setting a high price and then negotiating from there.

Price discounts came to colleges starting in the 80s, and they are everywhere today, making it terribly difficult to understand how much you’ll actually have to pay to attend a specific college or university.

Here are four research tools for families staring at a college “sticker” price and wondering what they’ll actually pay.

1. Net Price Calculators (NPCs)

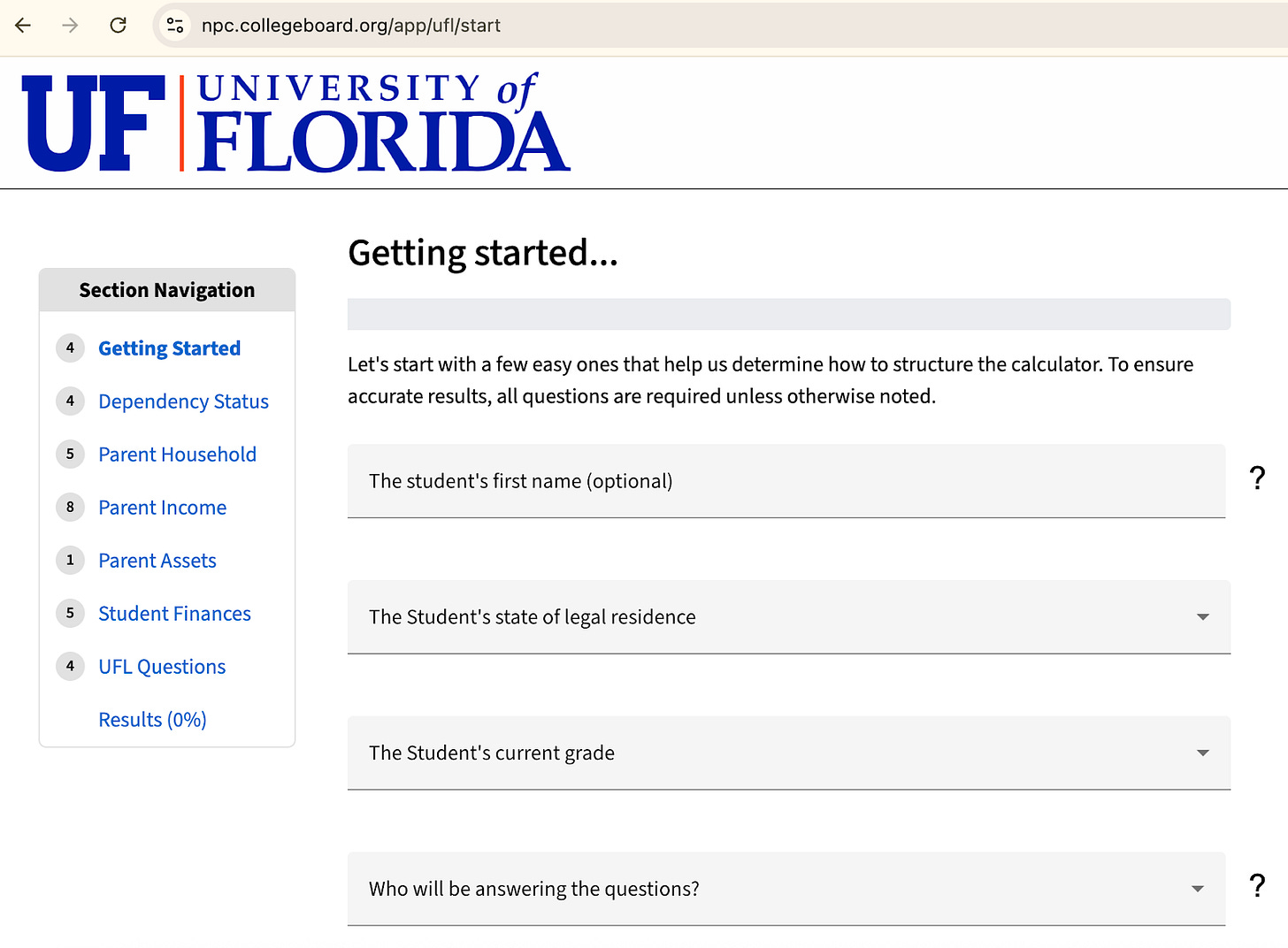

Every college that participates in federal aid programs (which is basically every college) must post an Net Price Calculator (NPC)—a web form that estimates your net price (the total Cost of Attendance, which means tuition, housing, books, fees, etc…, minus grants/scholarships) based on past students’ data.

Find it on the college website. Look for “Net Price Calculator” in Admissions or Financial Aid. Though, it’s often fastest to just Google it, e.g. “net price calculator Boston College”, “net price calculator University of Florida”.

Enter basic info. Income range, family size, assets, and sometimes grades/scores.

Interpret your result. The NPC returns an estimated annual cost—use this as your first filter.

Compare side‑by‑side. Bookmark each school’s NPC page and rerun with the same inputs for apples‑to‑apples comparisons.

Sticker price rarely equals what you’ll pay. NPCs break down tuition & fees, housing, and estimated grant aid so you can see your ballpark net cost before you apply.

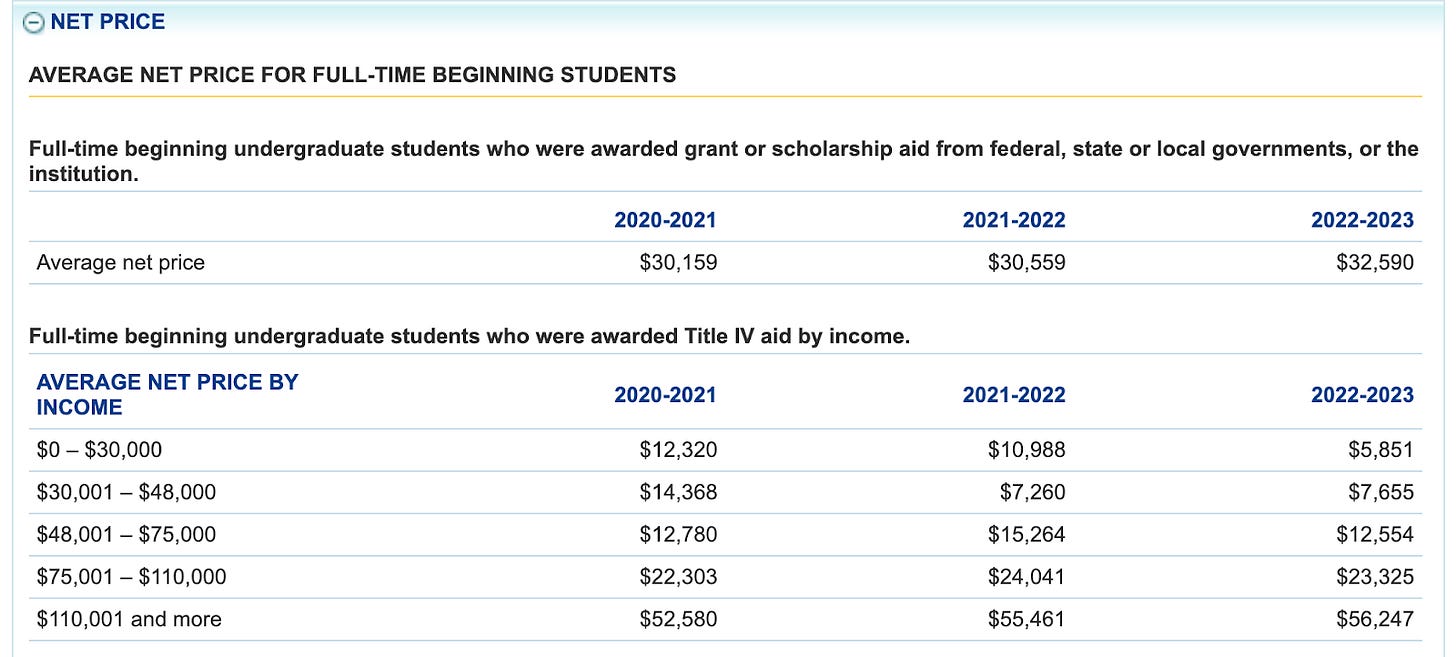

2. NCES College Navigator

The federal College Navigator site lets you dig deeper into each school’s historical data and filter by your family’s income bracket. Schools generally offer a mix of need-based financial aid and merit-based financial aid (aka merit scholarships).

Search your college name

Scroll to “Net Price” tables

Compare net price by income categories (e.g. <$30 k; $30 – 48 k; $48 – 75 k; >$110 k)

If your income bracket shows a net price far below sticker, that school is generous with need-based grant aid.

NPCs give your personal snapshot; College Navigator shows how real families in your income range fared last year—so you can gauge consistency and trends.

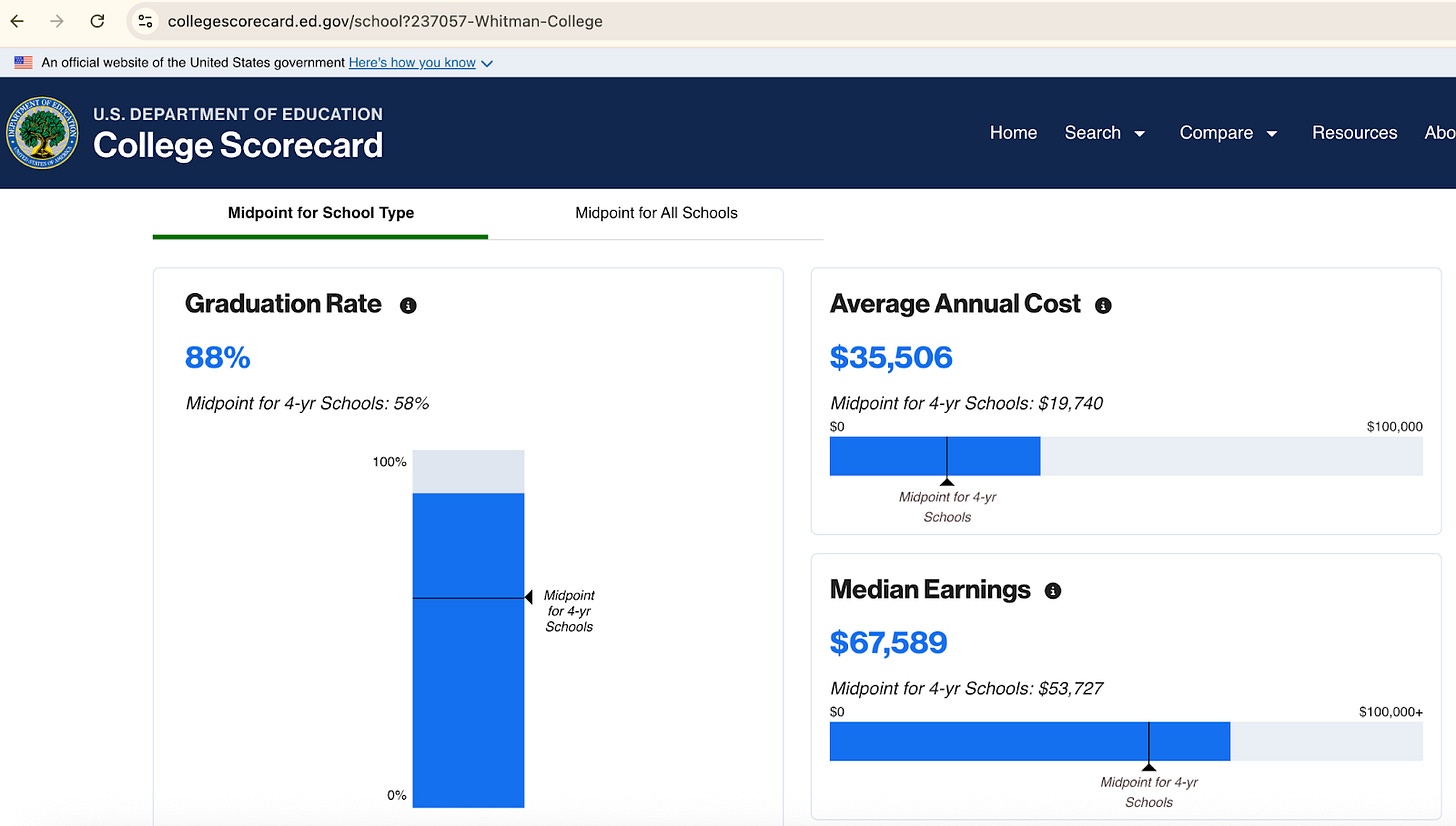

3. U.S. College Scorecard

Managed by the Department of Education, College Scorecard lets you compare schools’ net prices alongside outcomes.

Visit collegescorecard.ed.gov

Search by college name or filter by state, control (public/private), and net price range

Review “Average Net Price” and link it to metrics like graduation rate and median earnings

A school with a slightly higher net price but much better outcomes (e.g., 6‑year grad rate, earnings) may deliver more value long‑term.

Scorecard ties cost to return on investment—letting you weigh both price and outcomes in one place.

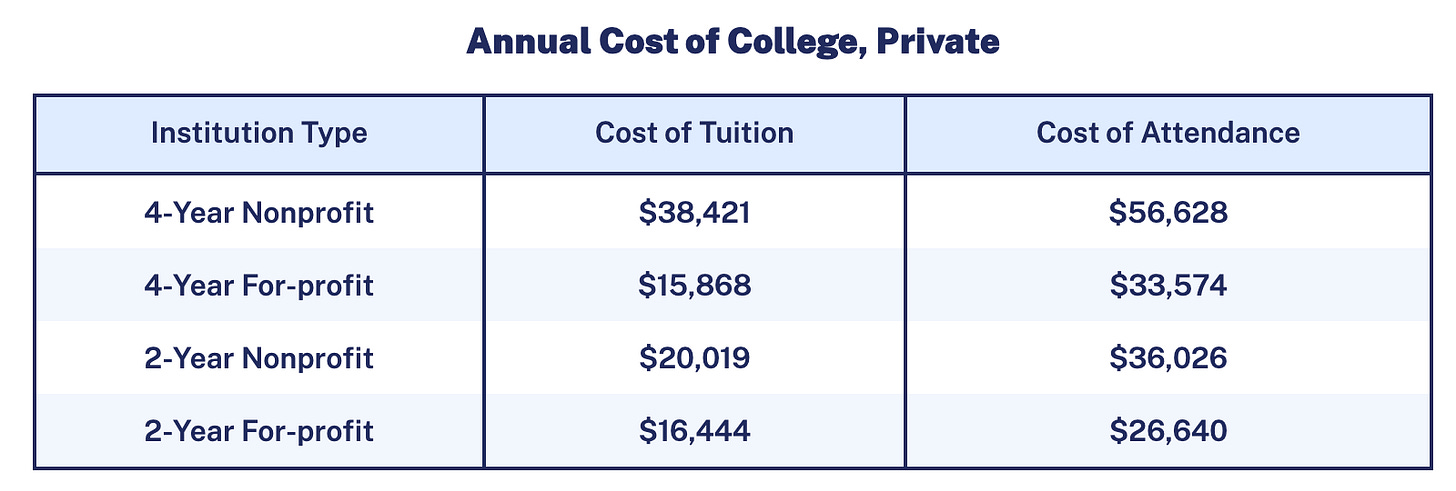

4. National Snapshot Data

Benchmarks such as those provided by the Education Data Initiative help you know if a school’s “net” price is unusually high or low.

Use these figures when a school’s NPC or Navigator result seems out of line:

Spot top‑tier aid: If a private nonprofit’s NPC shows a net price of $28 k (vs. $56 628 avg. COA), you’ve hit a strong aid bucket.

Ask questions when above average: If an in‑state public’s NPC returns $30 k (vs. $27 146 avg. COA), dig into merit‑aid and tuition‑freeze options (where the price you pay won’t go up during your time at the college).

Do keep in mind regional variations. For example, in-state tuition sticker price at University of Georgia is $10,034, and *many* in-state students qualify for Hope and/or Zell scholarships bringing costs even lower (sometimes free). In my home state, the University of Washington’s in-state tuition sticker price is $12,973 and there isn’t a state-wide merit scholarship system.