Scholarships and Financial Aid 101

Learn the basics of financial aid, including how to apply, key terms, and strategies to maximize your award.

The 2025 Federal Application for Student Aid (FAFSA) will be generally available on or before December 1, rather than its usual October 1 release. Students and families complete this form as a prerequisite for receiving financial aid. Here’s hoping the delay this year is significantly less (and less painful) than the 2024 roll-out.

Ahead of this year’s FAFSA release, I’d like to set the table on scholarships and financial aid by providing background information – how receiving money to help pay for college really works.

The key takeaways:

Take heart – most students don’t pay full cost.

Your most important source for scholarships and aid is a college itself.

You can, and should, be shopping for “financial aid offers” from different colleges.

The Price You Pay

Think of paying for college more like paying for airfare – just about everyone is paying a different amount for their place. The amount you’ll pay is based largely on your family’s ability to pay, which is what is calculated when you complete the FAFSA (there’s a similar financial aid calculator called the CSS profile - more on that later).

Some terms you need to know:

Cost of Attendance (aka, the sticker price) -> how much the college says it costs

– Discounts -> scholarships and financial aid

_____

= Net Price -> what you actually pay

Confusingly, most of the data you see about the cost of college is based on the cost of attendance, meaning the sticker price.

But, the majority of students don’t pay sticker price. The net price is much lower. This is what you should be comparing.

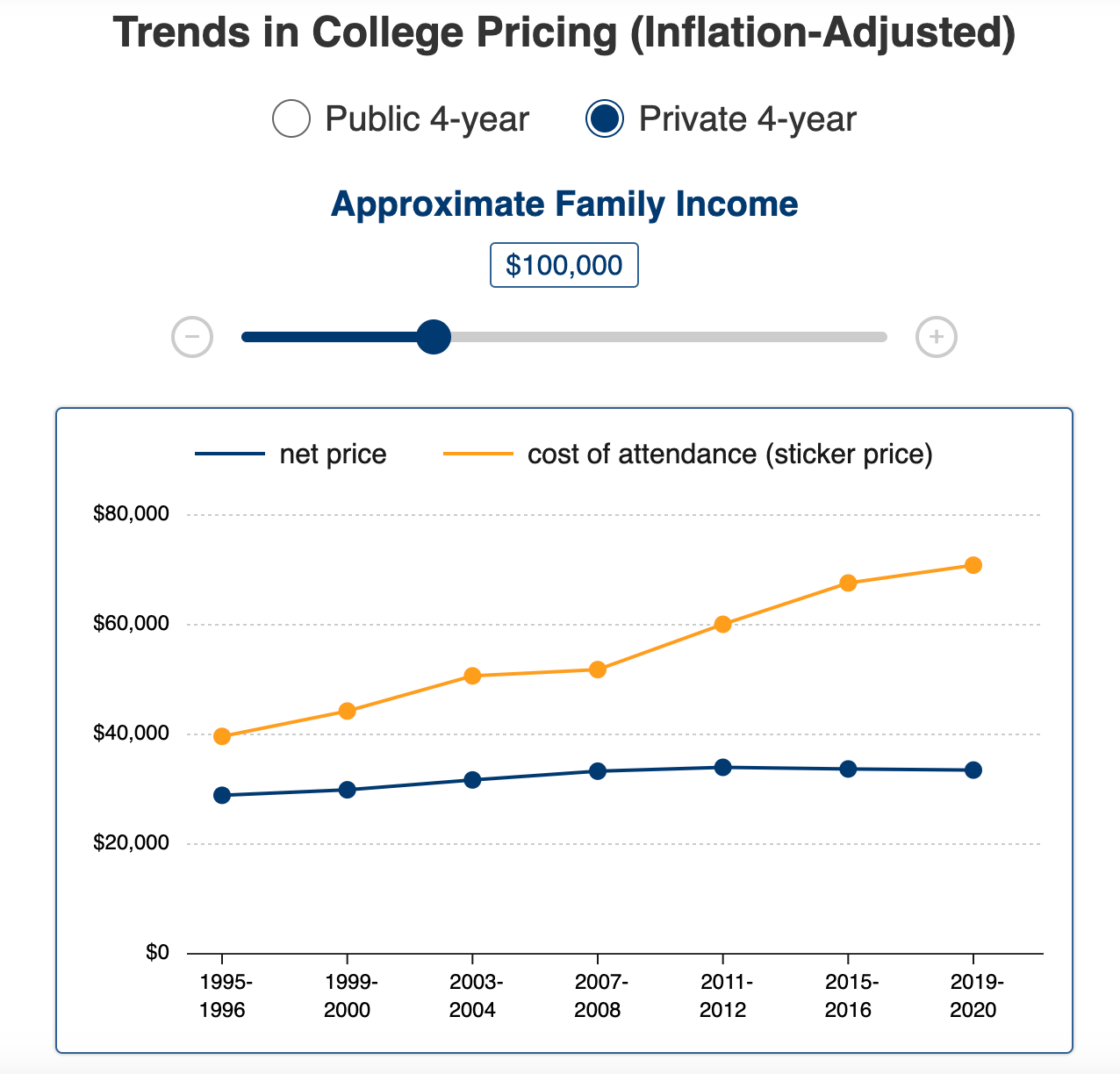

Here’s a view into cost of attendance vs net price from the Brookings Institution for a family making $100K a year and looking at private 4-year colleges.

Need Based Aid vs Merit Based Aid

Need-based aid helps families with limited financial resources cover college expenses, whereas merit-based aid recognizes and rewards students for their achievements and talents.

Merit-based aid is what most people think of when they say “scholarships”.

You can qualify for both types, so it’s important to explore all your options to make college more affordable.

Need-based Aid

What It’s Based On: Need-based aid is all about your family’s financial situation. Colleges and the government use information about your family’s finances to figure out how much your family can reasonably contribute towards college costs.

What You Can Get: Need-based age usually comes as a package. This type of aid includes grants (free money that doesn’t need to be paid back), low-interest loans (which you do pay back, but usually with better terms), and work-study opportunities (part-time jobs that help you earn money for school). Sometimes, work-study opportunities are referred to as “self-help” financial aid.

Why It’s Important: If paying for college is a major concern, need-based aid can make a big difference. It’s designed to help cover the gap between what your family can afford and what college actually costs.

Examples: Federal Pell Grants, grants from your state or school, and some scholarships based on your financial need.

How to Apply: You’ll need to fill out the FAFSA, and for some schools, you might also complete the CSS Profile. These forms help determine your eligibility for need-based aid. What’s the difference? The FAFSA is provided by the federal government and generally looks at prior year’s tax returns to understand your family’s income (how much your family earns). The CSS Profile, provided by the College Board (makers of the SAT and AP exams), goes much deeper and includes elements beyond income, such as whether or not your family owns its home and how much it is worth, in order to more thoroughly understand your family’s ability to pay.

NOTE: All families should complete the FAFSA regardless of income. Why? For one, eligibility for many merit-based scholarships requires this information. For another, need-based thresholds are higher than many families assume. Some may be surprised to learn that qualification for need-based aid can happen even for families that make more than $100K/year.

Merit-based Aid

What It’s Based On: Merit-based aid is awarded for your achievements. These could be your grades, test scores, athletic talent, or even leadership skills. It’s about rewarding students who have excelled in different areas.

What You Can Get: Typically, merit aid comes in the form of scholarships or grants, which means you don’t have to pay them back. Some schools automatically consider you for merit scholarships when you apply, while others might require a separate application.

Why It’s Important: Even if your family doesn’t qualify for need-based aid, merit-based scholarships can help reduce the cost of college by rewarding your hard work and talents.

Examples: Academic scholarships, athletic scholarships, and scholarships for leadership, music, or art.

How to Apply: Some merit scholarships are automatically offered based on your college application. Others might have separate applications, so be sure to research scholarship opportunities for schools you’re interested in.

Finding Schools Generous with Scholarships and Financial Aid

Need-based and merit-based aid can vary from college to college. That’s why it is important to build a college list that includes a range of schools, including those very likely to cost you less.

When aid is harder to come by, there can be a gap between what colleges are asking your family to pay and your actual ability to pay (called your Student Aid Index, from the FAFSA).

As a hypothetical example, suppose the total cost of attending a college is $50K and the amount you're expected to be able to pay is $30K (as calculated by the FAFSA). This means that there is a gap of $20K that needs to be filled with grants, loans, and scholarships for you to be able to afford this school.

$50K (Cost of Attendance) - $30K (Student’s Expected Family Contribution) = $20K Demonstrated Need

As a point of reference, the maximum Federal Pell Grant amount in 2024-2025 is $7,395. Even if you were to receive this, you’d still have over $12K left to cover.

There are generally two ways to fix:

The college or university itself provides financial assistance

You take out loans

It can pay (literally) to shop for financial offers from colleges. You do this by applying to colleges that are more generous with handing out financial assistance – need-based aid, merit-based aid, or both.

Colleges That Meet Full Demonstrated Need

Some colleges commit to meeting a student’s full demonstrated financial need.

This means that after evaluating your family's financial situation through the FAFSA (and sometimes the CSS Profile), these schools pledge to cover 100% of the financial gap between your family's ability to pay and the total cost of attendance.

Colleges that meet full demonstrated need often use a combination of grants, scholarships, work-study, and low-interest loans to make sure you can afford their education. These institutions tend to have significant financial aid resources and are typically more selective, but if you get in, they can be incredibly generous in helping you cover costs.

Schools with these policies can make a private or highly selective college more affordable than you might think, so it's worth considering them even if their price tag initially seems high.

Here’s a list of schools that guarantee to meet full demonstrated financial need.

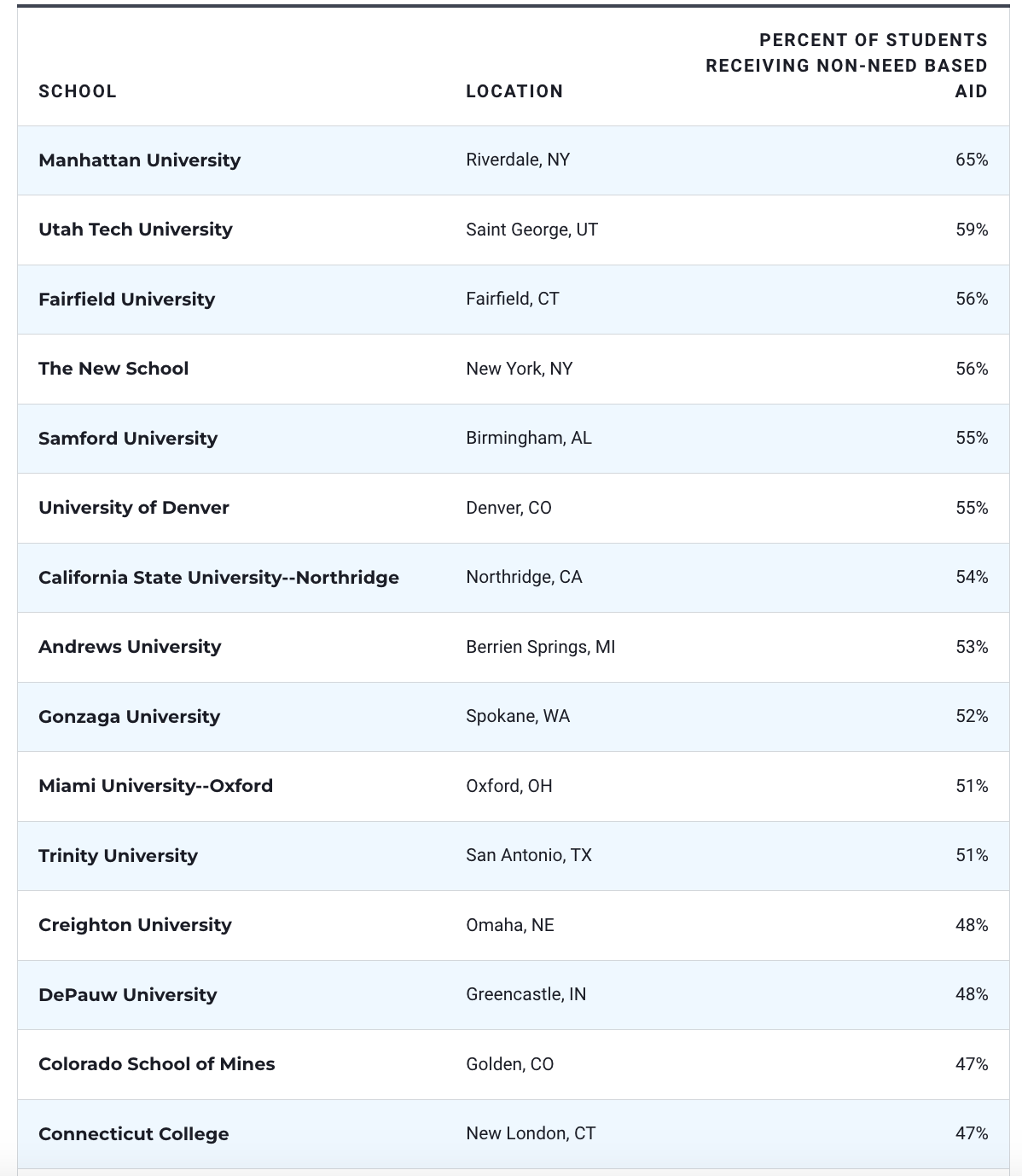

Colleges That Are More Generous With Merit Aid (Scholarships)

Some colleges are known for being more generous with merit-based aid, aka scholarships, which can make a big difference even if your family doesn’t qualify for need-based aid.

These schools often use merit scholarships to attract strong students, offering awards for academic achievement, leadership, or talent in areas like athletics, music, or the arts.

Merit aid may reduce the overall cost significantly, sometimes even covering a large portion of tuition.

While more selective schools tend to focus on need-based aid, many public universities and less selective private colleges are particularly generous with merit scholarships. These institutions may automatically consider you for merit aid based on your application or have separate applications for competitive scholarships.

It's worth researching which colleges prioritise merit aid, as this can dramatically lower your out-of-pocket costs.

Here’s a list of schools that are more generous with merit aid.