ROI and the Cost of College

Is a college degree worth the cost? The data continues to say “yes”, whether your major is computer science, elementary education, economics, mechanical engineering, psychology or art history.

If you're a student or parent wrestling with the question, "Is college really worth the cost?" you're not alone.

Given the rising expenses associated with higher education (a lot has been written about increases in cost), this is an increasingly common concern.

But let's dive into what the data actually says—spoiler alert: “yes”, college is worth it.

Quick Overview – Understanding College ROI

ROI—Return on Investment—is just a fancy term for comparing the cost of earning a college degree to the financial benefits it brings.

But what does the data really say? Here are three key points to consider:

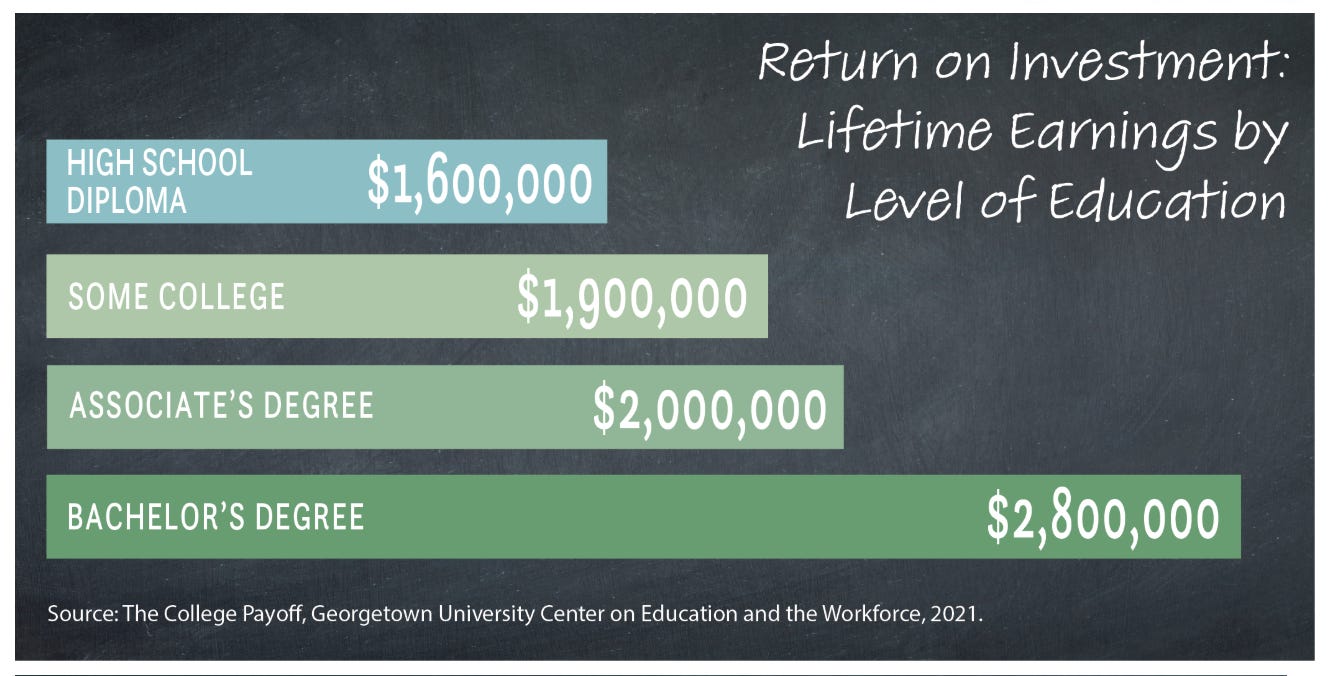

Earnings Potential: College grads earn significantly more—on average, about $1.2 million more over their lifetime—than those without a degree (source).

Debt vs. Earnings: Yes, student loans are daunting. And while debt load can feel overwhelming, consider the long-term earnings benefit. Average student debt upon graduation is ~$40,000 (source), and even after accounting for student loans, the average financial return clearly favours college grads.

Beyond the Paycheck: College isn't just about earnings. Degrees offer invaluable benefits like greater career flexibility, networking opportunities, and personal growth. These non-financial perks can dramatically enhance your life, though they're often overlooked in traditional ROI calculations.

Evaluating ROI for Your Family

When discussing college ROI, your unique situation matters—a lot. Here’s how to personalize your decision:

Major Matters (But Less Than You Think): It’s true—initial earnings for humanities grads are often lower than those in STEM fields. But here's the good news: unemployment rates for humanities grads are just as low as those for STEM majors, around 2-4%, and far lower than for those without degrees. Plus, humanities majors thrive in diverse fields like law, education, museums, and management. Public perception would have you believe that students with “arts” or “studies” in their major are more likely to be employed as a barista than in their field. This just isn’t true. Bottom line: study what excites you. Passion often pays off over the long run.

Career Goals Are Key: If your dream job requires specific credentials (like nursing, engineering, or accounting), college is a clear necessity, directly boosting your earning power and job security. But for more open-ended paths, ROI calculations may be less straightforward. Admittedly, college is not for everyone. Vocational training, community colleges, or certificate programs may offer better ROI for certain careers without incurring debt.

Scholarships Change the Math: Keep in mind that the sticker price is often not what you’ll pay (source). Aggressively pursuing scholarships, grants, and financial aid can significantly improve your personal ROI, making college more affordable.

Four Great ROI Resources

Here are four go-to resources that make conversations about college ROI easier and more insightful:

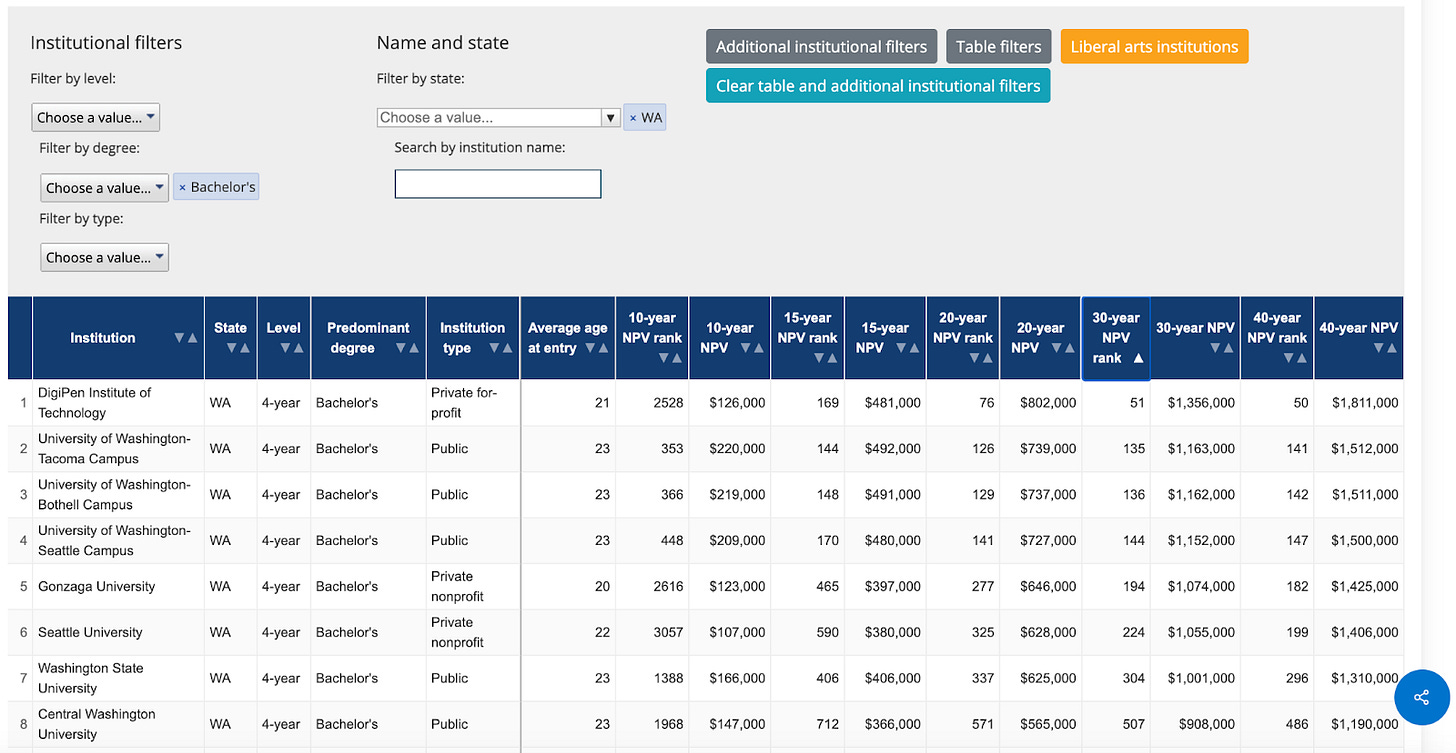

Georgetown’s Center on Education and the Workforce – Reliable research about lifetime earnings by major. This data is particularly helpful because you can compare ROI at 10yr, 20yr, 30yr, and 40yr intervals.

College Scorecard – An essential tool for comparing colleges based on cost, graduation rates, and post-graduation earnings.

PayScale College Salary Report – Insightful salary data by college and major.

Money’s Best Colleges – Great for assessing value based on your family's financial considerations and educational preferences.

In short, yes, a college degree is worth the cost for most people—and for some, comparing ROI between schools can be a helpful decision tool.