Merit Aid vs Need-Based Aid

Most families don’t pay sticker. Price colleges on net cost using both merit and need-based aid and give yourself room to compare by applying early, filing aid on time, and asking good questions.

According to an issue brief from the Strada Education Foundation, the share of first-time, full-time undergraduates receiving institutional grant aid at public four-year institutions increased from 49 percent to 62 percent between 2014–15 and 2021–22. The average discount rates increased from 24 percent to 31 percent over the same period.

Strada argued in the brief that tuition discounting sows confusion about the real cost of college among students and their parents. The practice also fuels increased public skepticism about the value of a college degree. It warned that growing financial uncertainty for public higher education could make the problem worse.

Fewer and fewer students are paying full price for college.

The average institutional tuition discount at private nonprofits: 56.3% for first-time, full-time freshmen; 51.4% across all undergrads (2024-25).

If you aren’t (yet) shopping for tuition discounts, you should be.

Run each school’s Net Price Calculator (NPC) to estimate your cost.

Check the school’s merit grid/scholarship page (automatic vs. competitive).

Apply Early to maximise your aid chances, and file FAFSA (for SAI, federal/state aid) and CSS Profile where required.

If circumstances change or you have a better peer offer, appeal politely

Two types of aid - fast definitions

Merit aid (scholarships/tuition discounts): Awarded for academics, test scores, talent, leadership, athletics, arts, etc. Often funded by the college itself as institutional discounts (automatic grids or competitive awards), plus outside/private scholarships. Renewal usually requires a minimum GPA or credit completion.

Need-based aid (from federal/state/institutional sources): Awarded based on family finances. Federal Student Aid uses the FAFSA to compute a Student Aid Index (SAI); many privates also use the CSS Profile for institutional aid. Packages can include grants (don’t repay), work-study, and loans. The net price is cost of attendance minus grants/scholarships.

100% demonstrated need met. A college promises to cover the entire gap between its cost of attendance and your family’s demonstrated ability to pay (based on FAFSA/CSS Profile). The aid package may include grants/scholarships, work-study, and—at some schools—loans. (Some colleges are “no-loan,” but many are not.) Here is a list: https://blog.collegevine.com/schools-that-meet-100-percent-financial-need

Need-blind admissions. A college reviews your application without looking at your ability to pay. Finances aren’t used in the admit/deny decision; aid is figured out after you’re admitted. Most colleges don’t do this! Again, here’s a list: https://blog.prepscholar.com/need-blind-colleges-list.

Helpful overview: https://studentaid.gov/understand-aid

Merit aid

Automatic vs. competitive

Some colleges post transparent GPA/test-based awards (automatic merit). Others run named, competitive scholarships. Example of cost-clarity + public grid: Whitworth’s new model and GPA scale: https://www.whitworth.edu/cost-clarity/

News context: https://www.insidehighered.com/news/students/financial-aid/2025/10/02/whitworth-resets-tuition-amid-pleas-cost-transparency

How colleges use merit

Merit is an enrollment strategy - widen the funnel, shape the class, and compete on price/fit (especially outside the most selective, need-only schools). Translation: strong GPA/testers often see significant awards.

Stacking with outside scholarships

Policies differ. Many colleges will reduce loans/work first; some adjust institutional grants (meaning they reduce your scholarship amount). Read the school’s scholarship/financial-aid FAQ for “outside scholarship coordination.”

Renewal rules

Know the GPA/credit requirements to keep your award each year. Put renewal criteria and any “use-it-or-lose-it” fine print on your tracker.

Important caveat - who doesn’t offer merit?

A number of highly selective, need-only institutions (e.g., Harvard, Princeton) do not offer merit scholarships; aid is 100% need-based. If merit is essential to affordability, build a list with merit-friendly schools.

A list of schools that do NOT offer merit aid: https://www.successkoach.com/post/schools-that-offer-no-merit-scholarships.

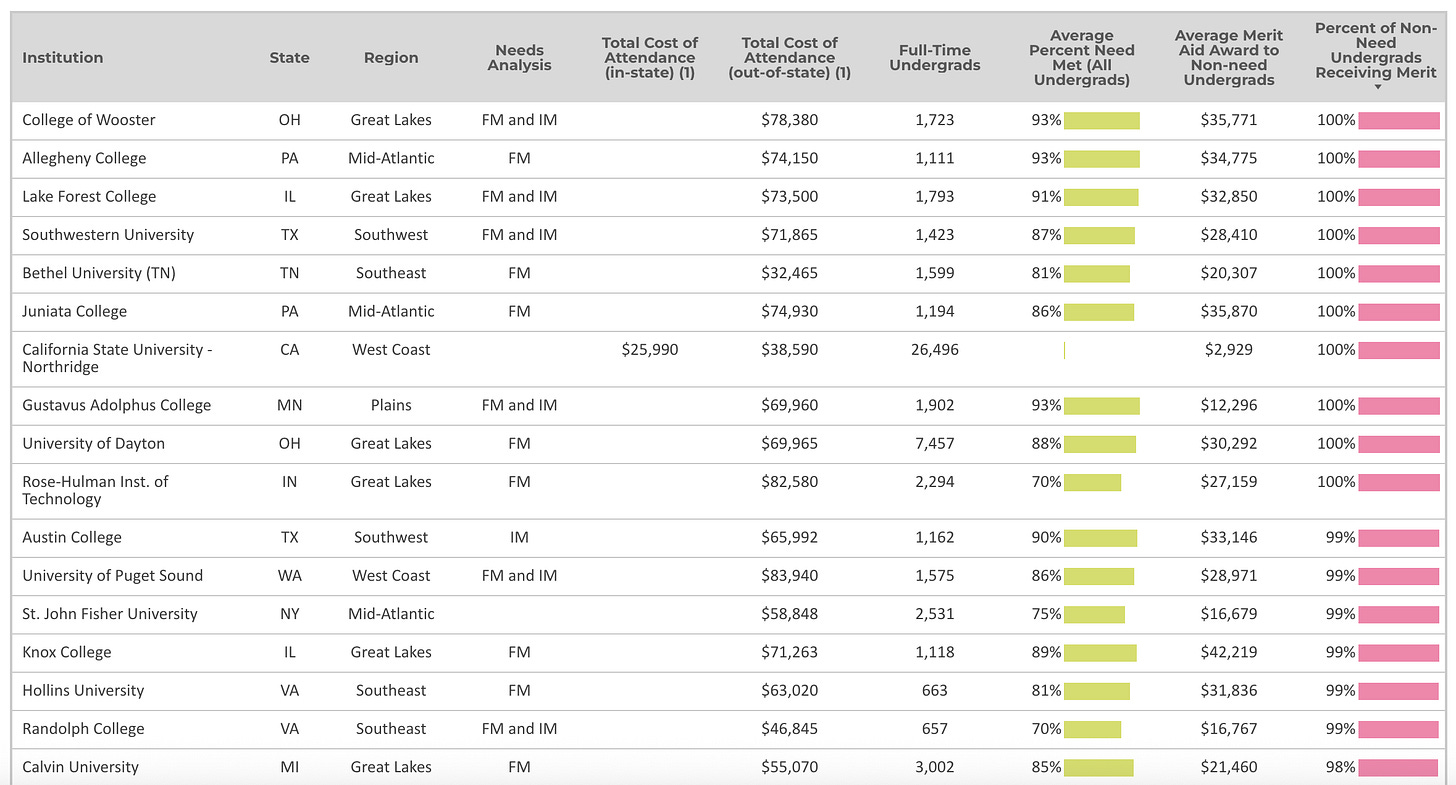

A list of schools that are generous with merit aid: https://lookerstudio.google.com/u/0/reporting/63ec4747-bbde-42d5-802b-afc8b9bb505a/page/dFARD.

Need-based aid

FAFSA → SAI

File the FAFSA to unlock federal grants (e.g., Pell), work-study, and many state/institutional funds. Info hub: https://studentaid.gov/

State programs

Most states offer grants/scholarships (example for WA families: WSAC). Search your state higher-ed site.

Institutional need-based aid

Colleges allocate their own grants. Some publicize “meets full need” and/or “no-loan” policies. Action: verify on each college’s financial-aid page (meets-full-need? no-loan? need-blind vs. need-aware?).

CSS Profile at many privates

The CSS Profile (College Board) collects a deeper financial picture (assets, home equity, business ownership). Deadlines can be earlier than admissions.

Start here: https://cssprofile.collegeboard.org/

How to Compare Financial Aid Offers

Grants first, then work-study/loans.

Compare net price across colleges using each school’s NPC and cross-check with College Scorecard (typical net price by income band, grad rates, and earnings).

NPC Center (finder): https://collegecost.ed.gov/net-price

College Scorecard: https://collegescorecard.ed.gov/

Discounting + “tuition resets”: What It Means

Sticker vs. net price

Record discounting across both public and private colleges means published prices are poor predictors of what you’ll pay; use Net Price Calculators and College Scorecard data instead to estimate what you may pay.

“Cost clarity” models

Whitworth’s reset pairs a lower list price with transparent GPA-based scholarships - you can estimate earlier and avoid “apply first, price later.” Other schools have these as well: e.g. at Arizona State University: https://financialaid.asu.edu/estimator.

Expect more schools to experiment with transparency.

Whitworth: https://www.whitworth.edu/cost-clarity/

NACUBO TDS summary: https://www.nacubo.org/Research/2025/Tuition-Discounting-Study-Summary

IHE overview on discounting/skepticism: https://www.insidehighered.com/news/quick-takes/2025/10/03/report-tuition-discounts-fuel-higher-ed-skepticism

Timing & Ethics: Apply Early, Decide On Time

Apply early; file aid forms early

Priority aid and scholarship deadlines often hit before Regular Decision (think: fall of Senior year for best scholarship and financial aid opportunities). Put FAFSA/CSS/Profile and scholarship dates on your calendar.

Appeal politely (3-step script)

What changed: new financial info or special circumstances.

Comparable data: attach a peer offer (if appropriate) or clarify what $ you need

Respectful ask: “If possible, could you reconsider my grant to close the gap?”

Early Decision (ED) basics

ED is binding. Use each school’s NPC beforehand. If the package is not affordable, you may request a reconsideration with documentation; if unresolved, you can decline on affordability grounds. Note that while ED may give an admissions boost (at some highly selective schools), it often limits financial aid and scholarship opportunities.

Deposits and deadlines

Compare offers through April. It can be okay to place a refundable housing deposit (if the college allows) while you compare, but do not double-deposit for admission. Decide by May 1 (or the college’s reply date).

More and more, colleges are “sweetening the deal” as the May 1 deadline approaches (and sometimes even past the deadline - ahem, Syracuse University) so it can literally pay to wait to make your enrollment decision.